Meta Platforms’ fourth-quarter revenue beat Wall Street expectations on Wednesday, but the company predicted sales in the current first quarter may not meet forecasts, sending mixed signals about how bets on pricey artificial intelligence-powered tools are paying off.

The Facebook and Instagram parent company expects first quarter revenue between $39.5 billion and $41.8 billion, compared with analysts’ average estimate of $41.72 billion, according to data compiled by LSEG.

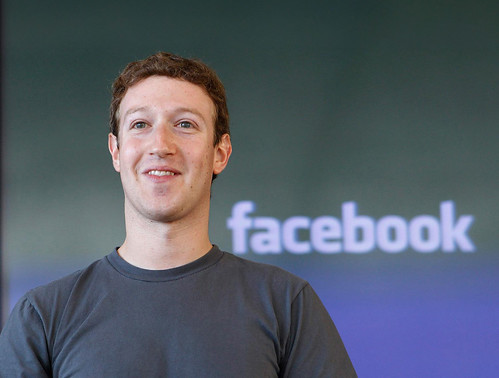

Meta shares were flat after the market closed but rose as CEO Mark Zuckerberg spoke optimistically about Meta’s AI initiatives and the company’s conviction that open source AI is the right strategy after a Chinese company launched DeepSeek open source AI, which tanked global markets.

“There’s going to be an open source standard globally,” Zuckerberg said on a conference call. “It’s important that it’s an American standard.”

The forecast raised fresh questions about Meta’s capital spending. The company relies on its core social media ads business to cover the costs associated with its AI ambitions and investments in “metaverse” technologies like smart glasses and augmented reality systems.

Last week, Zuckerberg announced that Meta plans capital expenditure of as much as $65 billion in 2025 to expand its AI infrastructure, while also increasing hiring for AI roles.

On Wednesday, Meta said it expected total expenses for 2025 to be in the range of $114 billion to $119 billion, up from a total of $95 billion in 2024.

“Meta’s gangbusters Q4 results clearly demonstrate that ad revenues remain the company’s lifeblood. That said, the biggest question heading into 2025 isn’t about today’s earningsit’s about whether Mark Zuckerberg’s $6065 billion AI infrastructure bet will pay off,” said Jeremy Goldman, principal analyst at eMarketer.

Family daily active people (DAP), a metric Meta uses to track unique users who open any one of its apps in a day, rose about 5% from a year earlier to 3.35 billion.

Meta’s results come after Chinese startup DeepSeek’s launch of its latest AI models triggered a selloff in global tech stocks on Monday on concerns about rising AI costs in the US.

DeepSeek has said its models either match or outperform top US rivals at a fraction of the cost, including Meta’s own Llama models, challenging the prevailing view that scaling AI requires vast computing power and investment.

Zuckerberg said it was too early to tell how DeepSeek’s emergence globally will impact Meta’s investment and capital expenditure strategy.

But what is clear are the lessons the new company could incorporate into Meta products. “There are a number of things that they have advances that we will hope to implement into our systems,” Zuckerberg said, addressing questions about DeepSeek.

The breakthrough could heighten scrutiny from investors worried about the company’s heavy spending on AI, though it may also benefit Meta if it successfully brings down the cost of building and supporting the models.

Meta among the top buyers of Nvidia’s sought-after AI chips aims to end the year with over 1.3 million graphics processors (GPUs) and bring about 1 gigawatt of computing power online, Zuckerberg said on Friday in a Facebook post outlining the company’s 2025 spending goals.

He said this month that Meta would lay off 5% of its “lowest performers” and warned employees about more such job cuts this year to raise performance.